extended child tax credit calculator

Get your advance payments total and number of qualifying children in your online account. Thats a pretty nice big perk of a.

Tax Calculator 2019 Flash Sales 52 Off Www Ingeniovirtual Com

If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per.

. Under Bidens plan qualifying households would get a credit of 3000 a year for every child aged between six and 17 and 3600 for every child under six. If you want to see how large your credit will be simply answer the four questions in the calculator below and well give you a customized estimate. Payments are scheduled to begin issuing from July however they could be delayed because the Internal Revenue Service IRS extended the deadline for filing taxes.

This tax credit is changed. Child age 5 and younger Max credit of 3600 each Child age 6-17 Max credit of 3000 each Phase-out The maximum value of the tax credit reduces by 50 for every 1000 in income above the. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18.

Child and family benefits calculator. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion.

You can use this calculator to see what child and family benefits you may be able to get and how much your payments may be. For children under 6 the amount jumped to 3600. 3600 per child younger than age 6 and 3000 per child between ages 6 and 17.

Enhanced child tax credit payments which give checks to families worth up to 1800 per child are set to end in 2021 unless Congress acts. That would mean they can claim the full credit when they file their 2021 taxes. First its value was boosted to a 3000 maximum for children aged 6 to 17 and a 3600 maximum for children under the age of 6.

First Time Homebuyers Challenge Fast-track your home purchase with this. Enter your information in the calculator to see how you compare to these three families. Calculate your monthly payment here.

How much will I receive per child. The payments for the CCB young child supplement are not reflected in this calculation. At the request of President Joe Biden the total amount of the child tax credit will be divided into monthly payments of 250 to 300 so the aid will be constant until the full amount is covered.

The cost of extending it until 2025 has been estimated at around 450 billion. Check what help you might be able to get with childcare schemes like tax credits Tax-Free Childcare childcare vouchers and free childcare or education for 2 to 4-year-olds. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

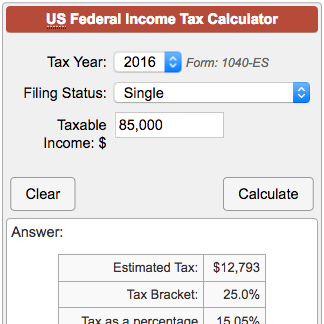

The boosted Child Tax Credit was also made fully refundable and. 2021 Child Tax Credit Calculator Estimate Your 2021 Child Tax Credit Advance Payments The IRS is no longer issuing these advance payments. You can use Kiplingers 2021 Child Tax Credit Calculator to see how much your monthly payments should be and how much should be leftover to claim as a credit on your 2021 tax return if youre.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The credit will be fully refundable.

Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. Heres an overview of what to know. Enter your information on Schedule 8812 Form 1040.

Start Child Tax Credit Calculator Dont get TurboCharged or TurboTaxed. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. The maximum benefit is 3600 per child under 6 and 3000 per child ages. The scheme would last for 12 months.

To reconcile advance payments on your 2021 return.

Pin By Rox Rodanco On Funny Crazy Cats Funny Comics Funny

Tax Refund Calculator 2020 Deals 52 Off Www Ingeniovirtual Com

Explore Our Image Of Monthly Spending Budget Template For Free Budgeting Worksheets Budget Template Worksheet Template

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Child Tax Credit Reduced Usage Of High Cost Financial Services The Source Washington University In St Louis

Income Tax In Germany For Expat Employees Expatica

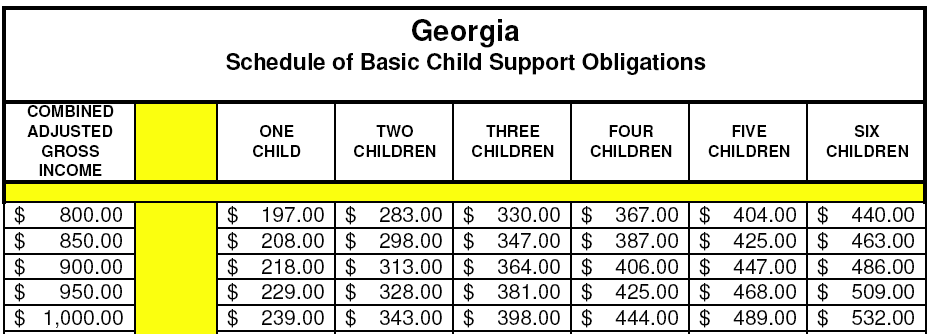

شريط جودة درجة الحرارة Georgia Income Tax Calculator Poksipon Com

شريط جودة درجة الحرارة Georgia Income Tax Calculator Poksipon Com

September Child Tax Credit Payment How Much Should Your Family Get Cnet

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

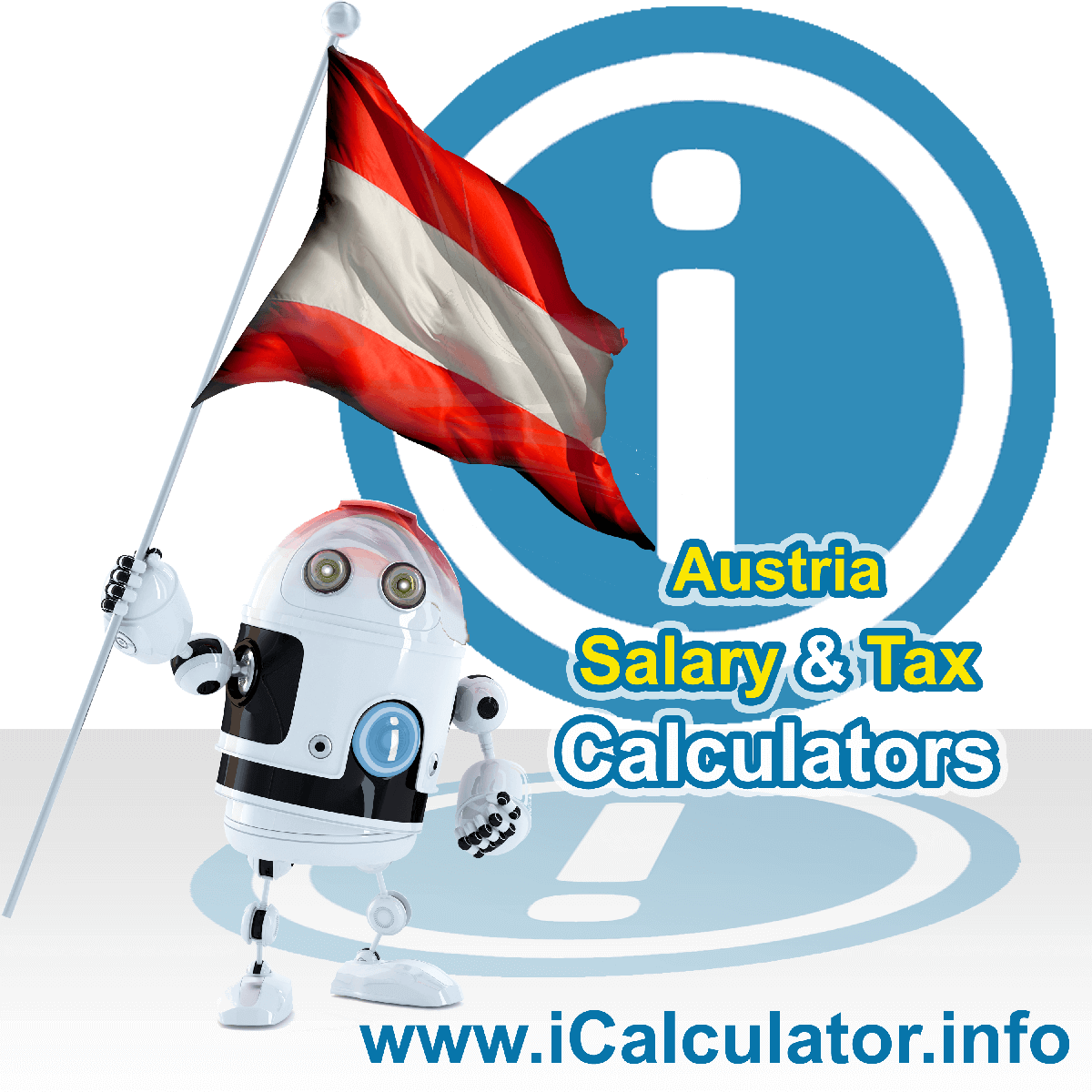

Austria Salary Calculator 2022 23

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Pay Tds On Time Or Else Face Imprisonment Tax Deductions Budgeting Paying Taxes

Tax Refund Calculator 2020 Online 58 Off Www Ingeniovirtual Com

Estimate Taxes For 2020 Deals 53 Off Www Ingeniovirtual Com

Tax Credit Definition How To Claim It

Income Tax Calculator Estimate Your Refund In Seconds For Free

2021 In Germany All Of The Changes Expats Need To Know About